Imagine being able to buy stakes in the potential success of young athletes before they reach stardom.

With Finlete, that’s now a reality.

Fans have always had deep personal ties to their favorite athletes and teams.

This revolutionary platform now gives them a vested interest in the potential upside of some of the brightest, amateur stars.

Rob Connolly, a previous 2x founder, initially came up with the idea in 2021 after seeing Fernando Tatis Jr. agree to one of the most lucrative contracts in MLB history.

Even though Tatis signed a 14-year, $340 million extension with the San Diego Padres, he still owed $27 million to an investment fund as part of an agreement he signed in 2018.

Connolly saw this and felt there was a better way to go about this concept where fans could participate instead.

And thus Finlete was born.

They’re now on a mission to help athletes and fans win together.

In this interview, we discuss the challenges he faced bringing this idea to life, how they select athletes for the platform, and his thoughts on hiring and building a team.

Hello, who are you and what is the name of your company?

I’m Rob Connolly, Founder & CEO of Finlete. I’m a seasoned entrepreneur based in San Diego, CA.

I’ve previously founded and scaled startups to successful exits including AgentBuzz (acq. OakParkCreative, September 2019) and HeroDogBox (acq. GetPetBox, March 2014). With this being my first startup in sports, I’ve surrounded myself with advisors with tremendous sports business experience.

Fernando Tatis Jr.’s story inspired me to start Finlete in 2022.

I remember the first time I heard about him.

Mark McGwire was a coach for the San Diego Padres at the time, and he had mentioned this prospect, Fernando, they were excited about, and that started the whole hype around him.

When he signed that massive contract, and he had to pay millions of dollars to this private hedge fund, I thought to myself, “What an interesting concept, but can’t we do better for both the athletes and the fans?”

What was the process of getting the company off the ground?

Launching Finlete began with validating the product-market fit (PMF).

We aimed to confirm robust demand from both athletes and fans for enabling fans to invest in athletes through Finlete.

The validation process involved several strategic actions:

1. Leveraging industry expertise: Recruiting a former C-level executive from Big League Advantage was pivotal. His deep understanding of athletes’ interest in future earnings deals provided us with invaluable insights and helped shape our business model. I also recruited an experienced sports-tech startup founder.

2. Engaging potential customers: Our unique position near Petco Park allowed us to engage directly with Padres fans, discussing the concept of investing in athletes’ futures, inspired by Fernando Tatis Jr.’s deal. These conversations not only helped validate the demand but also significantly grew our pre-signup list to over 1,000 enthusiasts without any marketing spend.

3. Building on prior ideas: The journey to Finlete included lessons from a previous venture, Meetlete, which focused on live video interactions with athletes. While Meetlete faced challenges, its core concept was integrated into Finlete, emphasizing the creation of a community for meaningful engagement between fans and athletes.

4. Analyzing industry history: Studying the trajectory of Fantex, a pioneer in offering fans a stake in athletes’ financial success, provided critical insights. Learning from Fantex’s mistakes allowed us to refine our MVP and business strategy to avoid similar pitfalls.

5. Ensuring legal compliance: Navigating the regulatory landscape was essential. Collaborating with securities attorneys experienced in alternative investments ensured that Finlete was structured correctly from the start. Opting for crowdfunding (Regulation CF) as our initial approach was strategic, aligning us with a familiar and regulated method of investment.

Each step was instrumental in laying a solid foundation for Finlete.

From leveraging industry expertise and engaging with our target audience to learning from past ventures and ensuring compliance with legal standards, our approach was methodical and customer-centric.

This strategy not only validated our business model but also positioned us for sustainable growth and success in connecting fans with athletes in mutually beneficial financial relationships.

How is the company doing today and what does the future look like?

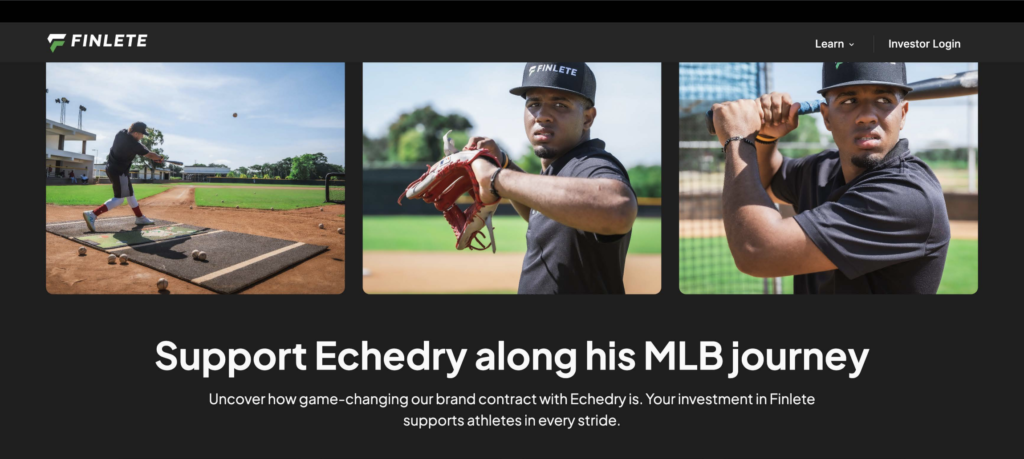

In January, we signed our first athlete, Echedry Vargas, a top prospect in the Texas Rangers organization, to a contract including 10% of his future MLB earnings.

Fans can own a piece of his potential upside by buying shares through the crowdfunding offering we launched in late February.

We’re now in the public education phase, educating fans and potential investors about this unique investment opportunity.

We’re also about to close our pre-seed round, which will enable us to greatly ramp up our marketing efforts, en route to selling out our initial offering.

From there we’ll increase the pace at which we sign additional athletes and launch subsequent offerings.

Our future seed round of capital will help us accelerate. It’ll also enable us to fully build out the web and mobile platform that’ll give Finlete the sense of community we’re after.

That’s where investors will be able to buy exclusive merchandise, virtual meet n’ greets, travel packages to attend sporting events with other investors, etc…

Take us through the process of identifying and selecting an athlete for the platform. Do you see a future where all athletes will be able to utilize Finlete to fuel their careers? If so, what level or sports do you see the platform appealing to the most?

We utilize a combination of new school and old school.

Scouts, talent evaluators, plus data and rankings. At this stage, we prioritize young prospects with tremendous potential upside who’ve been overlooked.

While we’d love to have athletes like Caleb Williams and Jackson Holliday on our platform, it’s not a fit.

Between NIL, large signing bonuses, and massive contracts being imminent, it doesn’t make sense for them.

We’re starting in baseball where there are scores of promising athletes who received very little by way of a signing bonus when they are drafted or signed as international players.

They need our support.

They need capital to focus on baseball year-round.

Focus is key in any startup, so we’re going to dominate baseball before expanding to numerous sports.

As we grow, the type of athlete we attract will expand. Our contracts aren’t one-size-fits-all. Athletes closer to or already receiving paychecks at the professional level will command higher valuations since their floors are much higher than longshots in college or the minor leagues.

Top-rated prospects will of course command higher valuations as well. At the end of the day, our mission is to help athletes along their journeys while giving fans the investment opportunities they’ve been shut out of to date.

We see a future in which a meaningful percentage of young professional athletes will want to utilize Finlete to fuel their early careers.

The opportunity to obtain risk-free capital (no repayment obligation if they don’t make it) to cover costs associated with family, training, development, etc is appealing.

As is the opportunity to instantly be plugged into a massive network of superfans, and fans who want to support athletes both emotionally and financially.

Through starting the business have you learned anything particularly helpful or advantageous?

The journey of launching Finlete has been marked by challenges and victories big and small, each contributing to our understanding and shaping our evolution.

Some Key Challenges:

1. Navigating legal complexities: Initially, we underestimated the intricacies of legal requirements surrounding athletes’ future earnings. This oversight necessitated a rapid and deep dive into legal knowledge, emphasizing the need for expert legal counsel.

2. Educating the market: Introducing the concept of investing in athletes’ futures posed significant communication challenges. Crafting a message that was both engaging and understandable proved to be more difficult than anticipated.

3. Community versus commerce: Pivoting from Meetlete to Finlete, while leveraging the value of the former, illuminated the delicate task of fostering a genuine community while pursuing commercial goals. Striking this balance without making the platform feel transactional was a complex endeavor.

Strategic Decisions:

1. Grassroots engagement: Opting for direct interaction with fans near Petco Park validated our market fit and built a foundational user base, demonstrating the power of personal connection and community engagement.

2. Studying the history: Learning from Fantex’s experiences allowed us to sidestep similar obstacles, informing our approach to business modeling and market entry.

3. Expert legal counsel: Working with seasoned securities attorneys from the start was pivotal in navigating the regulatory framework successfully.

4. Market timing: The launch of Finlete aligned with a surge in interest in alternative investments and a broader recognition of athletes’ financial strategies. This timing propelled our concept into the spotlight.

Lessons & Growth:

1. Prioritize great lawyers despite the cost: The early challenges underscored the importance of robust legal and regulatory planning. This lesson has been integral to our planning, ensuring that our efforts comply with and innovatively navigate legal standards. Structuring our unique business properly before launching will pay dividends for years to come.

2. The art of storytelling: We discovered the necessity of connecting with our audience through stories that resonate on an emotional and intellectual level, refining our approach to more effectively communicate our vision and value proposition.

3. Cultivate community: Our experiences have highlighted the essential role of building a platform that transcends transactions into relationships, fostering a space for meaningful interaction among fans and athletes, and embarking on new fan engagement territory.

Reflecting on the journey of starting Finlete, no two entrepreneurial paths are the same. Our experiences continue to inform our direction and we’ll adapt as the market evolves so long as we always prioritize what’s important to both our athletes and fan investors.

What advice do you have for founders looking to raise capital?

Raising capital is demanding.

It requires extensive groundwork, engaging pitches, and relentless networking.

Success begins with tapping into your network, including in-person industry events and platforms like LinkedIn and AngelList where warm introductions are king. It’s also way closer to a full-time endeavor than any founder cares to admit. You need strong team members to keep day-to-day operations running smoothly while you focus on raising capital.

Crafting a pitch deck is an art in itself, requiring a narrative that details the business model but also tells a compelling story.

It’s difficult to be concise and clear while still being thorough. I’d remind founders that every deck revision feels like the best one yet and that’s ok, just remember it’s never the last.

The art of building enduring relationships with investors is another key to my success. Just because an investor initially says no or wants to wait and continue to evaluate doesn’t mean you should end the relationship then and there.

Keep in touch, provide updates, and show persistence, and some early no’s might turn into yes’s. Handle rejection with resilience, view each ‘no’ as a step closer to a ‘yes’, and lean on a support network, which can be a combination of close friends, family, and fellow startup founders.

Are there any particular tools, software, or resources you use to be more productive?

In our journey to streamline operations at Finlete, we’re always looking for new innovative tools and software that can help us be more productive and efficient.

A few that come to mind are ChatGPT, Zapier, Figma, and Microsoft Clarity.

1. ChatGPT: So robust and versatile, we’ve used ChatGPT to help with everything from marketing to market research and we’re constantly uncovering new ways to leverage it. We use it to generate creative content, from blogs to social media posts, tailoring the communications to resonate deeply with different audience segments. For customer service, its ability to personalize communication at scale has been a game-changer, making our marketing efforts far more individualized and accurate. For market research, ChatGPT helps us compile and analyze performance data, scout reports, and generate insightful reports that support us in our decision-making processes.

2. Zapier: Its automation capabilities ensure seamless information flow from our crowdfunding offering to our CRM and marketing platforms, enabling high-quality follow-up and interactions.

3. Figma: Our team loves collaborating visually in Figma. It helps us work together seamlessly across time zones globally. From our website to marketing collateral, Figma is a tool we value tremendously.

4. Microsoft Clarity: This is a new one for me. My friend turned me onto it recently. Being able to see what actions users are taking on your website, particularly before they churn, is very valuable, especially when working on a unique offering like ours.

What advice do you have for founders trying to build a team and hire talent?

It’s critical to find the right talent and build a team that gels.

We’ve sourced talent from a variety of places, leveraging our networks for warm referrals, tapping into industry-specific events and meetups, and utilizing LinkedIn for a wider reach. Engaging with universities is always worth exploring too.

I always strive for a company culture that fosters camaraderie, recognition, and a sense of belonging. I start by defining the core values and ensuring they are reflected throughout.

Learning to delegate and trust others was a gradual process for me and I know I’m not alone on this one. Starting with smaller responsibilities allows me to gauge new team members’ reliability, effectiveness, and sweet spots in terms of their preferences and tendencies.

Clear expectations, providing resources and support, and having a regular feedback loop help foster a sense of trust and empowerment.

Some advice here would be to remember that the goal of managing people is not to make them exactly like you, it’s to bring out the best in them en route to achieving the company’s greater goals, so avoid the traps of expecting that everyone will do things the way you do, embrace the diversity of working styles, trains of thought, etc.

Are you currently hiring and if so, where can people apply and find out more?

Yes, we are always on the lookout for talented individuals who share our passion and vision at Finlete. I don’t believe we have any open roles on LinkedIn right now but we welcome proactive inquiries and applications.

If you’re interested in joining our team and believe you can contribute to our mission, we’d love to hear from you. Please reach out to us at info@finlete.com with your resume and a brief introduction about yourself and how you see yourself contributing to Finlete.

We appreciate the initiative and look forward to hearing from you.