Becoming a pro basketball player is hard.

And so is building a successful tech startup.

Matt Rum has done both.

After playing his college ball at William & Mary and then professionally in Greece, Matt took his talents to the Bay Area to work for tech giants such as Square and Cash App.

Then he caught the entreprenial bug.

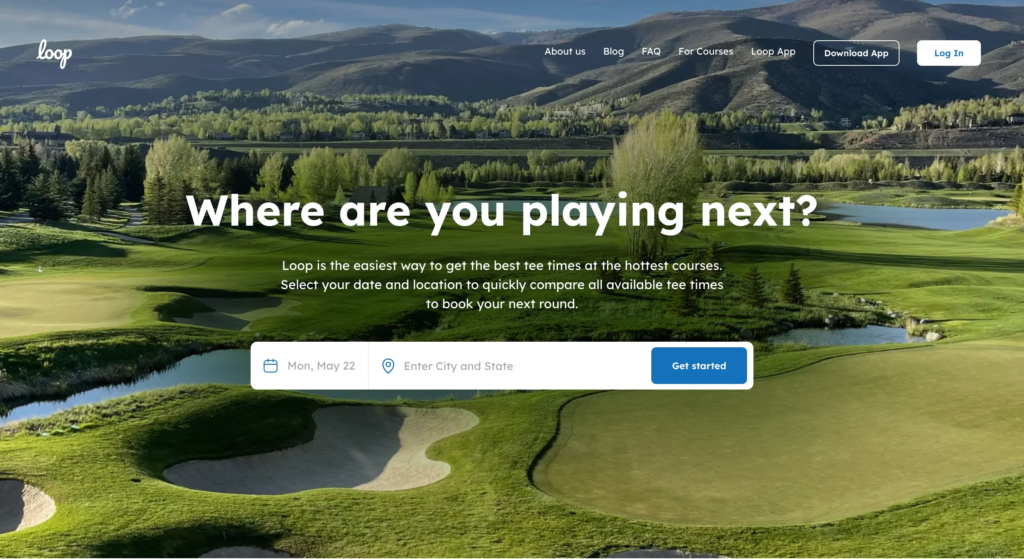

After 5 years of grinding away in the tech world, he and his business partner decided to merge their passion for sports with technology and launch LoopGolf.

Here’s the story…

Hello, who are you and what is the name of your company?

My name is Matt and my company is LoopGolf Club. My background is a mix of sports, tech, and payments. I played both college and professional basketball before moving west and getting into the startup space.

After spending 5 years at Square / Cash App, my partner and I saw an exciting opportunity to leverage our professional experience while pursuing our passion for sports by building golf’s premium on-course betting app.

Golf has always had a unique culture around competition which has often meant recreational players competing for real money (peer-to-peer). Historically, these games were tracked and managed by a paper scorecard and settled via cash.

Given the rise of popularity in both digital payments and sports betting here in the US, we knew there was an exciting business opportunity to bring this wildly popular part of the game into the digital age.

What was the process of getting the company off the ground?

Given the complexity around building a payments product in the “sports betting” space, for us, it all started by getting more educated about how best to navigate the legal hurdles to get started. We talked to all the major payment providers and banks and no one would take on our business.

While we were designing our product in 2020, we spent that full year working with a law firm to draft up our legal letter of opinion which became an essential piece of our business to begin stitching together the backend operations behind our payment stack.

In terms of how we thought through our MVP, we wanted to be innovative not only by bringing consumer payments into the sport but also through great product and brand design. Cash App was a major influence here and much of our early designs were inspired by their product and its clean minimalistic approach. Given the lack of focus on great design from the golf apps that have come before us, we felt like this could be a strong competitive advantage to begin winning over the next generation of golfers.

When seeking out advice or expertise in the early days, we began building out our suite of advisors almost from the beginning. We wanted to ensure that our blindspots were covered so we could avoid rookie mistakes in areas of the business that we weren’t experienced in. Software development was not our area of expertise and can often but full of landmines that can trip up non-technical founders. So we solved that problem by finding a few early technical advisors that we could trust.

When trying to find some initial PMF, we took the approach of getting a product into the golfer’s hands as fast as we could so we could begin receiving feedback and improving the experience. I’ll be honest, there were many frustrating days when we would be out on the golf course testing new features and the app would break sending the round into pure chaos. Software is tough and it takes a lot of money and a lot of time to get right.

How is the company doing today and what does the future look like?

We’re entering our second golf season with our product in the market. To date, we’ve organically grown our community to over 8K golfers and have processed over $400K in gross payment volume.

Our top priority this year is to introduce our subscription tier which will offer our players additional features, unlimited games, and access to players club events for $99 a year.

Our 2024 goal regarding subscriptions will result in our first profitable quarter with a target of Q3.

In terms of customer acquisition, we focus on three channels:

- Word of mouth (referral kickbacks)

- Instagram (paid ads)

- TikTok (viral content)

Through starting the business have you learned anything particularly helpful or advantageous?

The art of entrepreneurship is still very new to me and I still have SO MUCH to learn but here are a few of my key takeaways thus far.

- Building a business requires a sound body & mind. Especially to perform at the highest level when it’s crunch time. Take care of yourself. Eat clean. Work out and get your sleep.

- Momentum is huge. Great teams understand how best to leverage it.

- Failing over and over again is all a part of the job. Just don’t quit.

- Put in the work and avoid taking shortcuts. Quality takes time. Don’t rush the process.

- Leadership is hard. Be honest. Be vulnerable. Be curious. Earn your team’s trust and respect.

- Do whatever it takes to stay in the game. Survive and advance. This shit is March madness baby!!

What advice do you have for founders looking to raise capital?

Our fundraising journey has been a wild one. Full of highs & lows but ultimately it’s been a really valuable learning experience for us. For starters, we knew we wanted to show that we could design and build a beautiful deck that told a great story. We felt this was a critical step in convincing investors that we could eventually build a beautiful product.

By the time we had left our jobs at BLOCK, we felt confident that we had our deck and our pitch ready to start raising money. So in October of 2021, we started reaching out to friends & family, our professional network, high net-worth individuals, and small family offices.

In our first 12 months, we raised just under $1.3M via SAFEs. We were riding high and feeling good but quickly got humbled. Towards the end of 2022, we decided to shift our focus and look to close the remaining $700K from VCs and we hit a brick wall. We spoke to over 50 venture funds and we struck out hard. I didn’t even come close to receiving a term sheet.

At this point, we had spent a lot of the money we had raised to begin building our product and cover our overhead which nearly put us out of business on multiple occasions.

In hindsight, this was an extremely valuable lesson and has been a blessing for us. It’s forced us to restructure our business, cut operational costs, and get much more efficient with how we were spending our cash.

From my experience, it feels that early-stage companies are now being evaluated differently. Early-stage investors have seemingly shifted their focus to be more like growth equity investors. They want to see a path towards near-term profitability and we got blindsided by that. We were operating under the assumption that if we could show early signs of PMF, we could find a firm to invest in us without having to prove our revenue engines this early.

If I could do it all over again, I would have waited much longer before I started trying to raise institutional capital. Golf is the fastest growing sport in the US but investors still believe that it’s a very niche market. They couldn’t see a wrong in which we were operating in a big space for them to 10x their investment with us. We look forward to proving them all wrong.

What are some predictions you have for the industry over the next year?

Professional Golf will continue to evolve and it will look very different than it does today.

Players have benefited greatly from the PGA vs LIV battle but the fans have not (….yet).

Whichever league is the most innovative around how it looks to engage the next generation of fans will win. I believe the best way to do that is to drive more innovative live betting opportunities throughout the tournaments that keep fans coming back for more.

Imagine if the Masters App which allows you to watch every shot for any players on the course, added a live betting option to its UX.

That’s the future and we’re excited to see how it all shakes out.

Are there any particular tools, software, or resources you use to be more productive?

Beehiiv – for our newsletter, product updates, and investor updates.

Figma – for product design and brand design projects

Notion – for meeting notes and project management tracking

Slack – for company-wide communications

Linear – for managing our product workstreams

Mode – app insights and analytics

ChatGPT – copywriting, meeting summaries, etc.

What advice do you have for founders trying to build a team and hire talent?

Leverage your professional network first. Then I would recommend LinkedIn as a great tool for sourcing cold talent and rocket reach for scraping their email addresses.

In terms of our approach to hiring, we’ve always looked for the right blend of highly skilled, highly motivated, and highly trustworthy folks.

If you can find talent that checks those three boxes, you’ll be setting yourself and your company up for success.

Are there any books & podcasts you recommend?

I love learning from other entrepreneurs and their stories. So I would recommend “How I Built This by Guy Raz.

Are you currently hiring and if so, where can people apply and find out more?

Not currently hiring but we’re always open to chatting about future opportunities.